Paving at Ten

by

Ross M. Miller

Miller Risk Advisors

www.millerrisk.com

October 10, 2011

Paving

Wall Street was conceived in late January of 1999 in a hotel room

on a comfortable sofa in Beaver Creek, Colorado. Only it was not called Paving

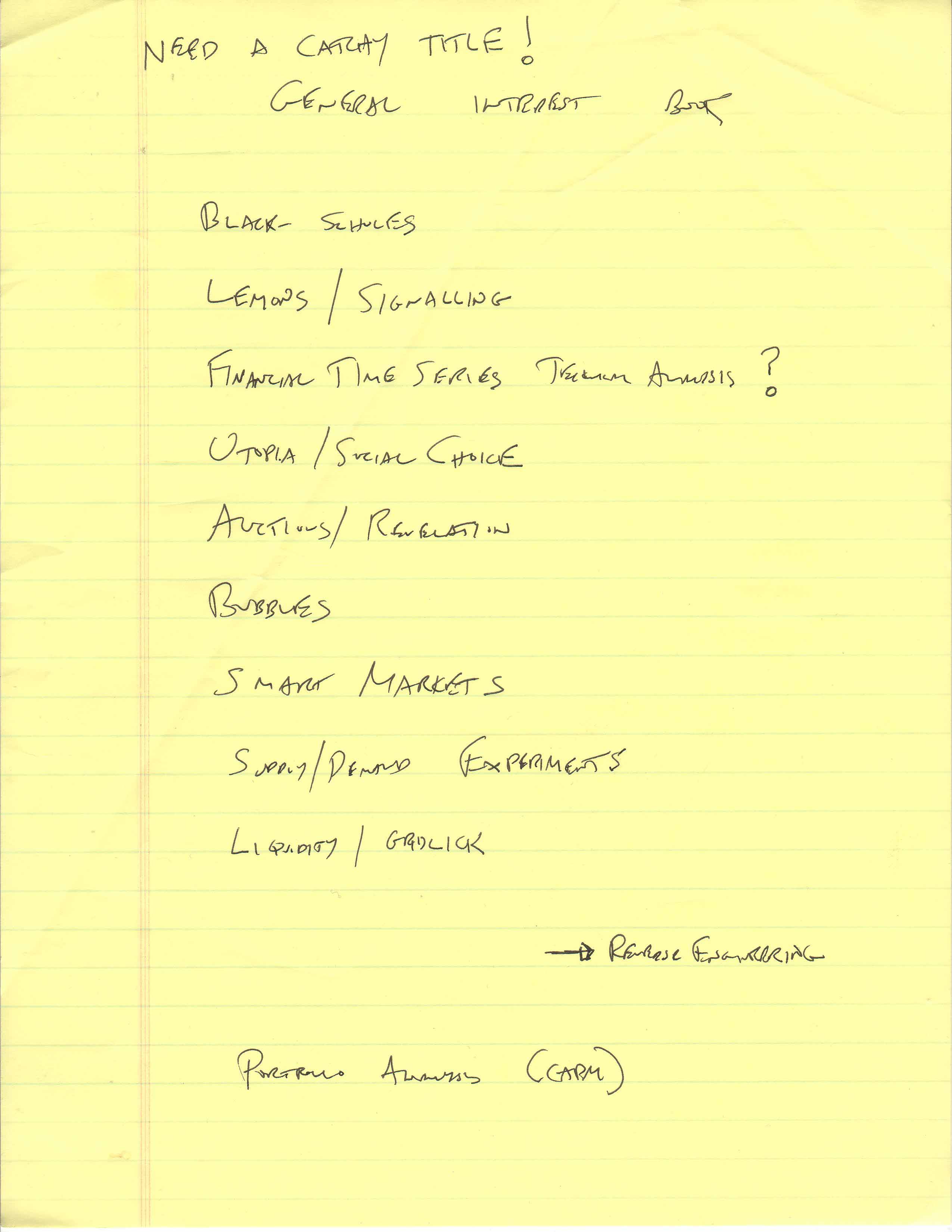

Wall Street then. In the first and briefest outline of the book, where

the book's title should have gone, all it said was "Need a Catchy

Title!" Paving was known simply as "the smart markets

book" for a while until I came up with the working title of Market

Maelstroms. I liked my working title, and still do, but the publisher

(John Wiley & Sons) did not. They wanted Recreating Capitalism,

but I do not view the world in terms of any "isms" and disliked

the dual meanings of the word "recreating." The only way to

convince them at the eleventh hour not to go with Recreating

Capitalism (possibly over my dead body) was to come up with something

(at about three-in-the-morning) they liked better, and Paving Wall

Street was it.

I was in Beaver Creek to attend a junk bond conference

hosted by Salomon Brothers. The conference was essentially one long

roadshow in the shadow of the ski slopes. Coming at the parabolic phase of

the Internet bubble, the sexiest companies at the conference were those

that were involved in laying optical fiber in the watery depths between

the continents. Global Crossing was the big name in the field, but Tyco

International did the actual work of getting the cable down to the ocean

floor. I learned just how easy it was to increase the bandwidth of the

fiber through multiplexing, which would ultimately lead to a massive glut

of fiber capacity and the literal sea of "dark fiber" that would

help bring down Enron and led to another chapter of my life. A day or so

into the conference I came down with a bad cold and so my time was split

between being miserable on my hotel room's bed and on its sofa. While on

the sofa, I wrote the first outline for what would become Paving Wall

Street in what I recall to be just a matter of minutes. Here it is:

My original idea for the book was that I would write

about the things in economics that I especially dug and I would try to

communicate them to my readers in a way that they would dig them, too. I

had planned to work on the book immediately on my return from Beaver

Creek; however, before the gel had dried on my outline I got a call from a

client with whom I thought I had wound things down only to learn that they

had been wound back up. It would be six months until I would have much

more than the scant single-page outline for the book. The second,

thoroughly hashed out, outline for Paving (not reproduced here)

looks very much like the final product; indeed, the cutesy names for many

of the chapters and sections came directly from that second outline. What

started as a bunch of things I like about economics turned into a more

coherent book about experimental finance that managed to shoehorn my

favorite topics into the general discussion.

I wrote Paving using my standard writing strategy

of creating masses of raw material (usually in a single writing jag from

8am to noon every weekday) and then mercilessly cut and shaped the

material until I got a book of reasonable size. This process required an

uneconomically large number of drafts, but produced a final product that I

could (almost) live with. What this all means, however, is that if there

is ever a second edition of the book, I can simply rescue all of the

material that ended up on the cutting room floor and create the author's

cut of the book, just as films have their directors' cuts. For example, Paving

originally had a good deal about Richard Feynman, with whom I had the

occasional chat when I was a Caltech sophomore. (More on that at some later

date.) Consider, for example, what I wrote about the famous two-slit

experiment that figures critically in his lectures:

Here is my golf version of the two-slit experiment,

which is technically incorrect, but gets the point across more

dramatically than the way physicists explain it.

Consider

two golfers at two different golf courses, for example, Tiger Woods at

Winged Foot in Westchester County, New York (down the road from all the

Connecticut hedge funds) and Sergio Garcia at Valderrama in Sotogrande,

Spain (not far from Gibraltar, another home for hedge funds). Imagine that

both of them are pitching golf balls at a flag at the center of a putting

green. Since they are both exceptional golfers, the balls form a nice

dispersion pattern centered on the flag.

Now let's

shrink the golf balls so that they are extremely small-down to the size of

subatomic particles like electrons. What the two-slit experiment tells us

is that if we observe Tiger and Sergio while they hit the tiny golf balls

everything is normal and the golf balls remain neatly dispersed around

each flag. On the other hand, if we turn our backs and do not observe who

hit which ball, some of the tiny golf balls will end up in the Atlantic

Ocean between New York and Spain. Indeed, as much as it goes against any

reasonable notion of reality, we live in a universe where events at the

subatomic level are so mysterious that events like "golf balls"

materializing out of nowhere are just the way things work.

When I switch into editor mode, I become aware that

there is a limited amount that I can get away with. As much as I liked

(and still like) my admittedly flaky take on the two-slit experiment,

including it in Paving would have cost me too many

"chips" for a book that is supposed to be about finance.

(Publishers work based on virtual chips; editors get chips to do what they

want to do occasionally and so do authors.) There was also a fair bit of

venting in various drafts of Paving that were fun to write, but

never would have (nor should have) gotten past my editors, so I

preemptively spiked them. (I did, however, manage to get some golf content

past the editor of the Journal of Economic Behavior and Organization

a few years later in a more

serious setting.)

As Paving approaches its tenth year in English,

let us just say that it has seen better days in the US (for now). In

Korea, however, it is a newborn. Published

in Korean just three weeks ago, Paving came strong out of the

gate. It goes by the Vernon Smith commemorative paperback title,

Experimental Economics, there. I don't know what the Korean subtitle

is, but it translates as: "Visible Hand Dominate the Market."

Coupled with the perplexing reviews translated from the Korean, I have to

wonder what is in the Korean translation. It has certainly occurred to me

that the translator may have taking extreme liberties with the book. It

also makes me wonder about the Chinese and Japanese translations of the

book that came out years ago to much less fanfare. I knew Paving

would be difficult to translate and tried to write it so that it would

survive the jump to Romance languages (my late mother was big into Romance

languages and spent much of her youth prior to my arrival as a translator

for the United Nations), but Asian languages are a whole other bag (I

wonder how that cliché translates into Korean).

Despite (or even because of) the ongoing collapse of the

global financial system, Paving has aged well. Some reviewers were

put off by the pessimistic and dystopian aspects of the book (and its

final chapter, in particular). In light of recent events, it is clear that

I was insufficiently pessimistic. The problems of the past ten years mean

that Wall Street needs a lot more than paving. Next month, I will continue

that train of thought by examining how the future changes our view of the

past.

Copyright 2011 by Miller Risk Advisors. Permission granted to

forward by electronic means and to excerpt or broadcast 250 words or less

provided a citation is made to www.millerrisk.com.